Medicare & Health Savings Accounts (HSAs)

A Health Savings Account (HSA) is a special account that can be paired with a High Deductible Health Plan (HDHP). It enables you to contribute on a pre-tax basis to an account to help pay for future healthcare expenses (i.e. medical, prescription drug, dental, vision, etc). But how does it interact with Medicare?

Let’s First Clear Up Two Common Misconceptions About HSAs

VIDEO: Medicare’s Impact on Health Savings Accounts (HSAs)

#1 - You Have To Stop Contributing To Your HSA When You Turn 65 — WRONG!

Most people believe that you must cease HSA contributions the moment you turn 65. This is simply not true. You must cease HSA contributions IF you enroll in any portion of Medicare. This means you can continue contributing to your HSA account (up to the individual or family HSA limits), as long as the HSA account owner doesn’t have any portion of Medicare just yet.

Note: If you are the HSA account owner and NOT enrolled in any Medicare, but your spouse who is on your health plan as a dependent enrolls in Medicare Part A, this will NOT impact your ability to contribute to the family HSA maximum.

#2 - You Have To Stop Contributing To Your HSA 6 Months Before You Turn 65 — WRONG!

As mentioned in #1, HSA contributions must stop when you actually enroll in a part of Medicare. The soonest your Medicare can start is the 1st of your birthday month (or one month sooner if you have a 1st of the month birthday). So why would someone think they need to stop contributing to their HSA 6 months prior to their 65th birthday? Well, there is a rule regarding Part A backdating that is confusing.

Medicare Part A is backdated up to 6 months from the month you enroll…BUT…it will start no sooner than your birthday/eligibilty month.

See link for details: When Does Medicare Coverage Start?

Many people fail to pay attention to the second half of the above statement (BUT…it will start no sooner than your birthday/eligibility month). This means that in the year your Part A starts, you can contribute to your HSA on a pro-rata basis, based on the number of months you DID NOT have Medicare.

VIDEO: When Medicare Part A is Backdated 6 Months

We expand on the 6-month backdating rule in our corresponding blog post and video: When Medicare Part A is Backdated 6 Months

Contributing To The HSA AFTER Age 65

This can be a great strategy for someone working beyond age 65 and staying in a group health plan, based on active employment. But it’s only a great idea IF the group health plan has “creditable” prescription drug benefits, the Medicare-eligible employee is not enrolled in any Medicare or Social Security retirement benefits, and is covered in a large employer health plan (typically 20+ employees at the employer). That’s because in this situation, no Medicare enrollment of any kind would be required. Reference our Misconception #2 in our Medicare Misconceptions blog post for more information on “creditable” prescription drug benefits, as well as what constitutes a “large” employer plan in Misconception #1.

When you do NOT have “creditable” prescription drug coverage through an employer, we see some Medicare-eligible folks knowingly accumulate a Part D late enrollment penalty in order to load up their HSA accounts while they can. This really should be a short-term solution because the longer you do this, the larger the Part D late enrollment penalty — when you do enroll in a Part D prescription drug plan. Typically, beneficiaries utilize this strategy when they know they will retire and/or lose group health coverage in a few years, usually 2 years or less. Otherwise, the penalty gets larger, and the strategy probably doesn’t make sense financially.

Don’t forget about the 6-month Part A backdating rule we mentioned earlier. When you eventually enroll in Medicare and/or Social Security benefits in the future, your Part A will be backdated up to 6 months from the month you submit the application for benefits. This can negatively impact your HSA contribution eligibility in the year Part A begins. Reference our blog post: When Medicare Part A is Backdated 6 Months

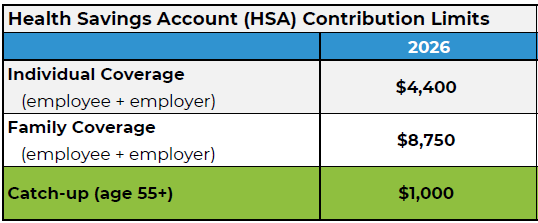

How Much Can You Contribute To A Health Savings Account (HSA)?

2026 HSA Contribution Limits

If the HSA account owner is NOT enrolled in any part of Medicare, the contribution limits are shown in the table to the right.

If you contribute to an HSA during the year your Medicare starts, be careful to not over-contribute, as there can be tax consequences. The amount you can contribute is pro-rated that year.

For example, if your Medicare starts April 1st, that means you weren’t on Medicare from January through March (3 months out of the year). So you can contribute 3/12’s of the HSA maximum contribution for the tax year, based on whether you have individual or family health insurance coverage. You can also contribute 3/12’s of the $1,000 catch-up (if you’re 55 or older).

Note: If you are the employee who owns the HSA, and your spouse who is on your employer health plan has Medicare Part A, that does NOT impact your ability to contribute to YOUR HSA up to the HSA Family max.

Tax Consequences Of Over-Contributing

If you over-contribute, there could be tax consequences…a 6% excess contributions tax. Additionally, excess contributions are NOT tax-deductible. Reference IRS Publication 969 & Publication 502 for more details.

Contact a tax professional for confirmation of tax rules associated with excess HSA contributions, as tax law changes can occur often.

Approved HSA Expenses Specific To Medicare

You can use your HSA for any qualified medical expenses approved by the IRS*, including, but not limited to:

Premiums paid to Medicare (i.e. Part B, Part B IRMAA, Part D IRMAA)

Premiums paid to an insurance carrier for Stand-Alone Part D Prescription Drug Plans

Premiums paid to an insurance carrier for a Medicare Advantage Plan (Part C)

Medical copays, coinsurance, deductibles

Prescription drug copays

Dental, vision, hearing costs

You CANNOT use your HSA to pay your:

Premiums paid to an insurance carrier for a Medicare Supplement (Medigap) plan

Remember to reference our corresponding blog post (When Medicare Part A Is Backdated 6 Months), as this will impact your HSA contribution eligibility in the year your Part A starts.

* Note: HSA account balances can be used for qualified medical expenses.

Reference Links

Medicare.gov

When Does Medicare Coverage Start?

Medicare Misconceptions

IRS Publication 969

IRS Publication 502

When Medicare Part A is Backdated 6 Months

Neither Medicare Mindset LLC nor its agents are connected with the Federal Medicare program.