Avoiding Medicare Penalties

There are 3 possible penalties related to Medicare…Part A, Part B, and Part D. See the details below on how to avoid these penalties, as well as the reference links at the bottom of the page.

Part A (hospital)

As long as you have at least 40+ quarters (about 10yrs of work in your lifetime) paid into Medicare taxes, there is never a penalty for enrolling in Part A late.

Yes…in this situation, you can add Part A at any point after age 65 without a late enrollment penalty.

If you don’t have the 40+ quarters, but your current spouse does, and they are at least age 62…then you can get Part A through their work record.

Part B (medical / outpatient)

As long as you’re covered on an employer health plan (based on your ACTIVE employment or your spouse’s ACTIVE employment), and you don’t have more than an 8-month gap in coverage after turning 65…you will not be penalized for enrolling in Part B late.

However, depending on the number of employees at the employer, you may need Part B when turning 65:

For employers with 20+ employees, Medicare is OPTIONAL. That’s because the employer health plan is still primary insurance when you turn 65. Medicare would be secondary insurance, if you enroll.

For employers with under 20 employees, Medicare is REQUIRED. That’s because Medicare is primary insurance in this instance. The employer health plan would become secondary insurance.

When Part B is needed in the future (e.g. you’re retiring and losing health insurance), you can add Part B literally any time while covered on the employer health plan based on active employment…or…up to 8 months after separating service from the employer.

Part D (prescription drug)

7-month Initial Enrollment Period (IEP) for Medicare Parts A, B, and D

To avoid a Part D late enrollment penalty, you need to obtain Part D prescription drug coverage during your 7-month Initial Enrollment Period (IEP).

HOWEVER…

If you have CREDITABLE drug coverage through some other source, you can delay Part D drug coverage until you lose your existing drug coverage.

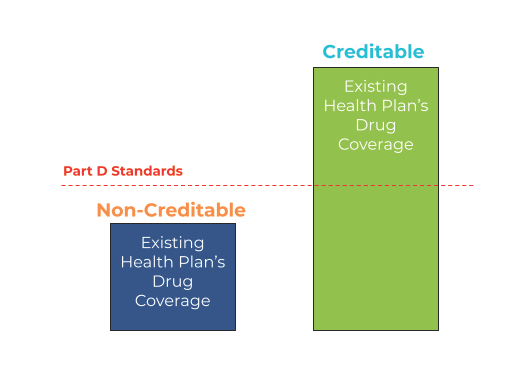

Creditable drug coverage is prescription coverage that meets or exceeds Medicare Part D minimum standards. Not all health plans have creditable drug coverage.

Examples of Creditable Drug Coverage Are:

Employer-sponsored health insurance plan (if you’ve confirmed the drug benefits are creditable*)

Veteran’s (VA) drug coverage

TriCare

Indian Health Services

And of course, Part D drug plans and Medicare Advantage (Part C) plans

*If you’re covered on an employer health plan, confirm with your employer’s HR department if your health plan has creditable prescription drug coverage. They can provide you a letter annually that confirms this.

See more details on creditable drug coverage HERE.

Neither Medicare Mindset LLC nor its agents are connected with the Federal Medicare program.