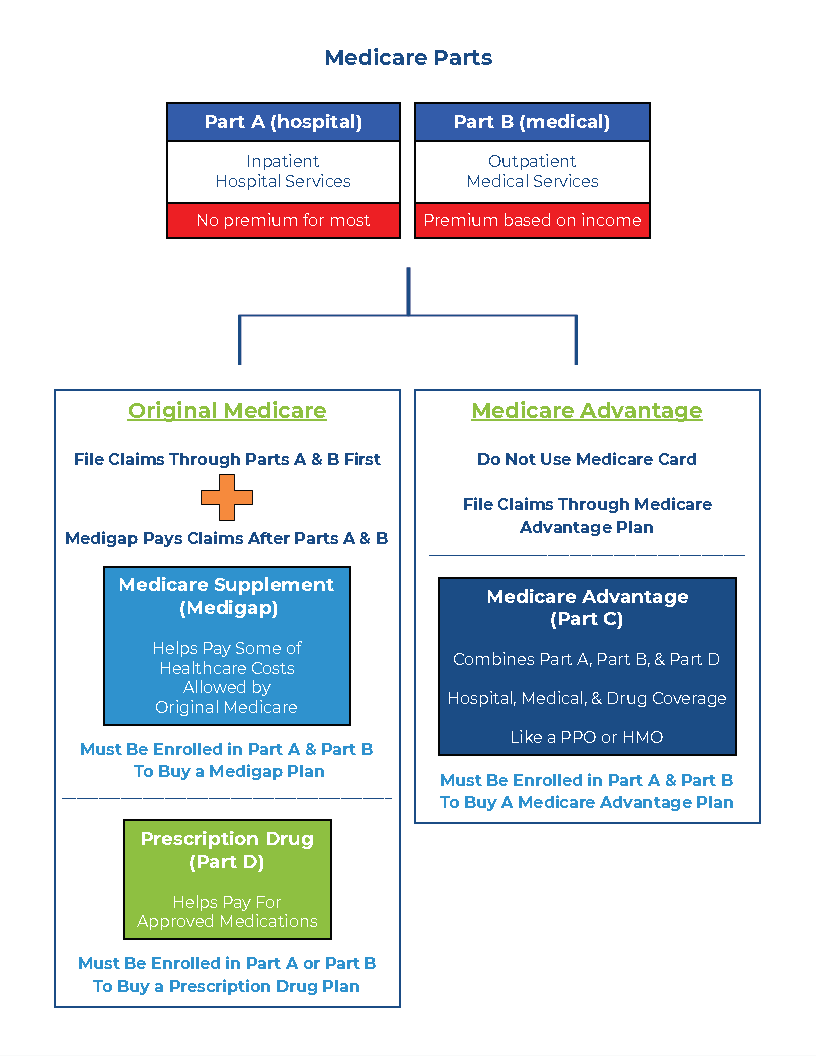

One of the biggest decisions a Medicare beneficiary struggles with is whether to choose Original Medicare or a Medicare Advantage (Part C) plan. There are a lot of considerations and it’s easy to get things mixed up. This post (and video) will breakdown the similarities and differences between Original Medicare and Medicare Advantage and provide a clearer view of how to make the choice.

NOTE: When we reference “Original Medicare”…the assumption is Original Medicare (Part A & Part B) as primary coverage, plus a Medicare Supplement (Medigap) plan as a supplement, and a stand-alone Part D prescription drug plan for medications.

Similarities

Premiums Paid to Medicare

The monthly premium you pay for Medicare Part B coverage will be the same in both scenarios. It’s all based on your income two years ago.

Covered Medical Services

Medicare covers / allows many medical services under Part A (hospital) and Part B (medical). Medicare Advantage plans are required to cover those same services.

Note: Medicare Advantage plans more commonly utilize Prior Authorization for certain medical services before they can be approved. So sometimes you’ll need to go through a few hoops to get an expensive test or procedure approved.

Prescription Drug Costs Are Separate From Medical Costs

It’s important to note that while on Medicare, your prescription drug costs are completely separate from your medical costs. These two items are independent of each other. You will have drug costs that have no connection to the costs you incur on the medical side of Medicare. This is true whether you have a stand-alone Part D prescription drug plan, or a Part D plan built-in to a Medicare Advantage plan.

Part D Drug Coverage Phases Are The Same

Whether you have a stand-alone Part D drug plan on the Original Medicare side, or Part D drug coverage through a Medicare Advantage (Part C) plan…the Part D rules work the same way. All the phases of Part D are identical, but every plan is unique in which medications they cover. See more on how Part D works HERE.

Differences

Access to Medical Providers

Original Medicare:

You have access to any medical provider in the United States (and U.S. territories) who accepts Medicare patients. You can look up providers with the Physician Compare Tool.

If the provider accepts Medicare, your Medicare Supplement (Medigap) plan will also be accepted…with ANY insurance carrier.

Medicare Advantage:

You typically have access to a list of providers in the Medicare Advantage plan’s network (PPO or HMO).

PPO networks provide some level of coverage whether you are in-network or out-of-network. If you are in-network, your cost share for a service will typically be lower than if you are out-of-network.

HMO networks provide only in-network coverage, except for emergencies. Medicare Advantage plans offer worldwide emergency care coverage.

Filing Medical and Drug Claims

Original Medicare:

Primary Medical Insurance: You will use your red, white, and blue Medicare card for all Part A (hospital) and Part B (medical/outpatient).

Secondary Medical Insurance: If you have a Medicare Supplement (Medigap) plan, you will use that plan’s ID card as your supplemental medical coverage. It will coordinate with your Original Medicare.

Prescription Drug Insurance: Prescription drug claims are run through a stand-alone Part D prescription drug plan with its own ID card.

Medicare Advantage:

You will NOT use your Medicare card here. Instead, you will only use your Medicare Advantage plan ID card for all medical (Part A & B) and prescription drug claims (Part D).

Total Monthly Insurance Premiums

Original Medicare:

The combined Part B premium, Medicare Supplement (Medigap) plan premium, and Part D prescription drug plan premium usually amount to MORE than the Medicare Advantage route.

Medicare Advantage:

The combined Part B premium and the Medicare Advantage plan premium usually amount to LESS than Original Medicare.

Out-of-Pocket Medical Costs

Original Medicare:

Your out-of-pocket medical costs are dependent on which Medicare Supplement (Medigap) plan you choose as your supplement to Original Medicare. But in general, you won’t have much in medical costs going this route.

If you choose one of the most popular Medicare Supplement (Medigap) plans (i.e. Plan G, Plan N), you will have minimal out-of-pocket medical expenses. The expected out-of-pocket costs are very limited and defined.

Medicare Advantage:

Your out-of-pocket medical costs in a Medicare Advantage plan are dependent on your medical usage. If you’re healthy and don’t seek very much medical care, you shouldn’t have much out-of-pocket medical costs.

If you have a bad health year, a Medicare Advantage plan protects you with the medical maximum out-of-pocket limit (MOOP). Every state has unique plans, so the MOOP limits can vary widely. This could end up being MORE out of pocket compared to Original Medicare with a Medigap plan.

Dental

Original Medicare:

Medicare does NOT cover most dental services, such as routine cleanings, fillings, dental procedures, etc., so a separate dental insurance might be necessary.

It’s possible that Part A might cover emergency dental services when admitted as an inpatient in a hospital.

Medicare Advantage:

Many Medicare Advantage plans provide built-in preventive dental services.

Comprehensive dental services are sometimes built-in.

Vision

Original Medicare:

Services associated with medical issues, such as cataracts and glaucoma, are covered.

Preventive vision care, such as routine eye exams and eyeglasses, are NOT covered, so a separate vision insurance might be necessary.

Medicare Advantage:

Services associated with medical issues are covered, just like Original Medicare.

Preventive services are often built-in (i.e. eye exams, eyeglasses)

Hearing

Original Medicare:

Routine hearing services and hearing aids are NOT covered.

Medicare Advantage:

Many plans have built-in hearing services and hearing aid discounts/allowances.

Additional Benefits

Original Medicare:

Original Medicare has a set list of approved/allowed services.

Medicare Advantage:

Many Medicare Advantage plans include extra benefits that go beyond dental, vision, and hearing.

Check the plan’s summary of benefits to confirm if any additional benefits are included.

Switching Plans & Pre-Existing Conditions

Original Medicare:

Medicare Supplement (Medigap) plans can be changed anytime of year. Initially, a Medigap has no health questions when you start your plan in the first 6 months of having Part B. However, if you switch from one Medigap plan to another Medigap plan, and your Part B has been in effect for 6 months or longer, pre-existing conditions can come into play. Your medical history will determine approval.

Note: A few states allow additional flexibility to switch Medigap plans without medical underwriting.

Prescription Drug (Part D) plans can easily be switched during the Annual Election Period (AEP) between October 15th and December 7th. There are no health questions.

Switching from Original Medicare to Medicare Advantage is easy. You must do it during AEP, though. There are no health questions.

Medicare Advantage:

Medicare Advantage (Part C) plans can be be switched during the Annual Election Period (AEP) between October 15th and December 7th. Also, the Medicare Advantage Open Enrollment Period (MA-OEP) between January 1st and March 31st is another time frame to switch to another Medicare Advantage plan (or to go back to Original Medicare) There are no health questions to switch from one Medicare Advantage plan to another Medicare Advantage plan. But if you go back to Original Medicare, a Medicare Supplement (Medigap) plan may have medical underwriting (approval is not guaranteed).

Switching from Medicare Advantage to Original Medicare can be harder. Going back to Original Medicare is fine, and so is purchasing a Part D drug plan (during AEP or MA-OEP)…but the Medigap plan would look into your pre-existing conditions in most cases when coming from Medicare Advantage. Though, there are special circumstances where your health history won’t matter (i.e. moving to a different state).

Bottom Line

There is a lot to consider when comparing these two Medicare Coverage Choices. We recommend you start by considering these three things:

Budget — What can you afford, today and in the future?

Access — Do you want access to medical providers anywhere in the U.S.? Do you travel a lot? Do you live in a different part of the country for extended periods of the time? Or do you usually access the providers that are available in your area?

Expected Usage — Are you a moderate or high utilizer of medical services, because of existing medical issues? Or are you pretty healthy? Would you rather have relatively open access on your providers and pay more premiums up-front to avoid excessive medical expenses when they occur? Or are you willing to work within a plan’s provider network and pay lower premiums up-front with the expectation of only paying for medical services as needed (up to a max out-of-pocket limit)?

Reference Links

Physician Compare

Neither Medicare Mindset LLC nor its agents are connected with the Federal Medicare program.