* Medicare Part B premium is based on income

Previously, we explored the ins and outs of Original Medicare, layered with a Medicare Supplement Plan (Medigap) and a stand-alone Part D prescription drug plan. But there’s another (important) part of Medicare coverage available to beneficiaries: Medicare Advantage (Part C).

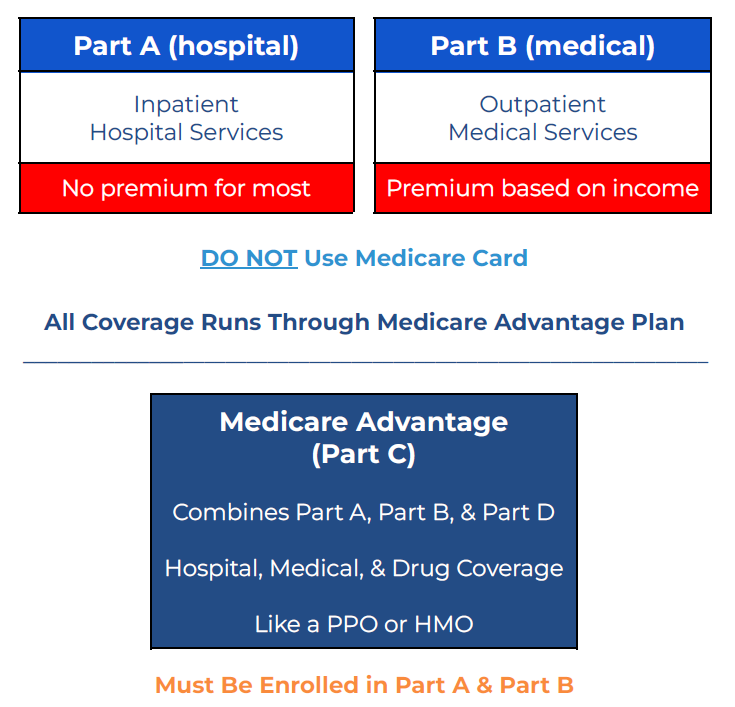

Unlike Original Medicare…which has a primary medical plan (Medicare A & B), a supplemental medical plan (Medigap), and a separate prescription drug plan (Part D)…with a Medicare Advantage plan, you just have one plan that handles all medical and prescription drug claims. This means your claims for Part A (hospital), Part B (medical/outpatient), and Part D (prescription drug) can all go through the one Medicare Advantage plan (A+B+D = Part C in this case).

The Medicare Advantage plan is administered by an insurance carrier of your choice, but the number of Medicare Advantage plans and insurance carriers available to you are based on your home state and county. Depending on where you live, you may have 50+ plan options, or you could have less than 10.

Read on for an overview of Medicare Advantage

Monthly Premiums for Medicare Advantage

It’s important to remember that no matter which Medicare Advantage plan you choose, you will still pay* the Medicare Part B premium to the government. Some people think that enrolling in a Medicare Advantage plan somehow allows them avoid paying the Part B premium. That is not the case. You will pay the Part B premium ($185/mo is the standard premium in 2025) PLUS the Medicare Advantage plan premium…if it has a premium (some don’t).

You read that right. Some Medicare Advantage plans have a $0/mo premium. How do they do that? Well, Medicare Advantage plans are primarily funded by Medicare. When you enroll in a Medicare Advantage plan with an insurance carrier, Medicare sends significant dollars each month to the insurance carrier. The insurance carrier then decides if it can support the plan appropriately without any additional premium dollars from the policyholder. If not, there will be a monthly premium.

And the premiums are not based on your age. That means these plans have a community-based premium rating system. So, a 65-year-old can pay the same premium as a 95-year-old, if they are in the same Medicare Advantage plan.

NOTE: If you are Medicaid eligible, you might not have to pay your Medicare Part B premium.

How to File Medical and Prescription Drug Claims

This part is pretty easy. With Medicare Advantage, you put your Medicare card away and only use the Medicare Advantage plan ID card to file all claims. You just need to give the medical provider your Medicare Advantage plan insurance card. The medical provider will file the claims on your behalf. The same goes for prescription drug claims at the pharmacy. Your pharmacist will handle this for you.

Access to Medical Providers

A Medicare Advantage plan usually has a network of preferred providers. This means if you receive medical services from an in-network medical provider, you will have lower out-of-pocket costs compared to when you receive services from an out-of-network provider. That just described a PPO plan network. But you have to be extra careful with a HMO plan network, as the HMO plan won’t cover out-of-network benefits for non-emergencies.

When you are traveling outside of your plan’s network, it’s important to understand your provider access (i.e. when on vacation). Some PPO plans give you access to a nationwide PPO network when traveling, but that’s not always the case. Some HMO plans also give you access to a travel network as well. Review your plan’s Summary of Benefits and Evidence of Coverage to confirm your medical provider access when out-of-network.

Here is more detail on the two types of provider networks:

PPO (Preferred Provider Organization) — A PPO gives you access to in-network providers at a contractually agreed upon cost (in the form of a copay or coinsurance percentage). The plan pays a portion of the medical service cost, and the policyholder typically pays the remainder (i.e. copay). If you go out-of-network, you can still get help from the plan, however you will typically pay a higher copay or coinsurance amount for the service.

HMO (Health Maintenance Organization) — An HMO gives you access to in-network providers only. Because of this, you will need to be extra careful about which medical providers you see for medical services. If the provider is out-of-network, the plan does not have to cover anything. The only exception is for medical emergencies. If it’s an emergency and you are out-of-network, the emergency is covered as though it’s an in-network event. This is incredibly helpful when you’re on vacation and away from your providers. That does bring some relief. However, it’s not foolproof. Keep in mind that you might not be ready to go right back home the day after your emergency ends. You may need additional medical services, which are considered non-emergency, in the days following an emergency. And those services might be considered out-of-network and not covered by the plan whatsoever.

Extra Benefits Not Covered By Medicare

Medicare Advantage plans are required to cover (allow) the same services as Original Medicare, but many Medicare Advantage plans go above the bar and include additional items. Some of these services are built-in, and some require an extra monthly premium. Here are just a few examples of what could be included in a Medicare Advantage plan with no additional premium:

Dental (preventive and/or comprehensive)

Vision (eye exams, eyeglasses, and contacts)

Hearing (hearing exams, hearing aid allowances, or discounts)

Fitness membership (i.e. SilverSneakers or similar)

Over-the-counter benefits (allowance to pay for household items like vitamins, supplements, toothpaste, etc)

Part D Prescription Drug Coverage

Medicare Advantage plans can also include Part D prescription drug coverage. Part D works the exact same way here as it does in a stand-alone Part D plan. Reference our post on the phases of Part D to get all the details. It’s especially important to note that even though a Part D plan can be included in your Medicare Advantage plan, the medical and prescription drug portions of the plan DO NOT apply toward each other. So, even if you reach the Medicare Advantage plan’s medical maximum out-of-pocket limit, you will still be required to pay the necessary copays for any prescription drug purchases.

Out-of-Pocket Costs

Medical — All Medicare Advantage plans are required to have a maximum out-of-pocket (MOOP) limit on the medical side, which limits what your total medical expenses can amount to for approved medical services in the plan. Check the plan’s Summary of Benefits for details.

The plan can also have a medical deductible before the plan covers any medical services. This isn’t true in all cases, but normally you see a $0 deductible if you are in-network, and a potential deductible when you are out-of-network. Again, check your plan’s Summary of Benefits for details.

Prescription Drug — On the Part D prescription drug side, the plan can include a deductible before it covers any prescription costs. However, that deductible can be no higher than $590 in 2025. Not all plans have a deductible, though. Some determine the deductible level on whether you are purchasing a generic drug or brand name tier drug. After the deductible phase of Part D, you will pay either a copay or coinsurance amount for each drug…based on the drug’s tier, the pharmacy it is purchased at, and which phase of Part D you are in at the time of the purchase. But thankfully, starting in 2025, there is a cap of $2,000 (including your deductible) on covered drugs on your plan’s formulary list if drugs.

Pre-existing Conditions & Switching Plans

There are no health history questions to enroll in a Medicare Advantage. This is true even when you want to switch plans. It must be done during certain enrollment election periods. When you switch plans, you typically must complete the enrollment process during the Annual Enrollment Period (AEP), which spans October 15th-December 7th. A plan change during this time frame will result in a January 1st effective date for the new plan.

During the AEP, you can switch from your current Medicare Advantage plan to any other Medicare Advantage plan available in your area…with the same insurance carrier or a different insurance carrier.

NOTE: If you intend to switch back to Original Medicare and purchase a Medicare Supplement Plan (Medigap), the Medigap plan can ask questions about your health history to determine your eligibility and premium (if your Part B start date was more than 6 months ago, or you are beyond your 12-month Trial Right period in Medicare Advantage). Some states have different rules regarding Medigap plan underwriting.

Reference Links

www.Medicare.gov

Part D Coverage Phases